There’s no denying that the crypto industry has taken a beating over the past year. With prices plummeting and investors fleeing, it’s been tough for everyone involved. Recently, however, there seems to be some change happening, and it’s happening on Polygon. Here’s our analysis of what this spike in users on Polygon is telling us about the crypto industry at large.

A Brief Introduction to Polygon

Polygon (https://polygon.technology/) is a decentralised finance platform that has seen a surge in users and activity during the bear market. In fact, Polygon is now one of the top 10 most active protocols.

This has created an influx of crypto natives eager to explore and invest in new product offerings. As a result, several major brands have begun developing decentralised applications using Polygon’s tools.

Polygon, formerly known as Matic Network, is a collection of scaling technologies designed to improve the scalability of Ethereum through Plasma chains and “rollup” solutions. Optimistic and Zero-Knowledge varieties are two of the most popular solutions offered by Polygon.

The project is backed by some of the big names in the space, including Coinbase Ventures, Binance Labs, Andreessen Horowitz, Sequoia Capital, Alan Howard, Tiger Global, and Softbank Capital, among many others.

High Activity, Low Cost

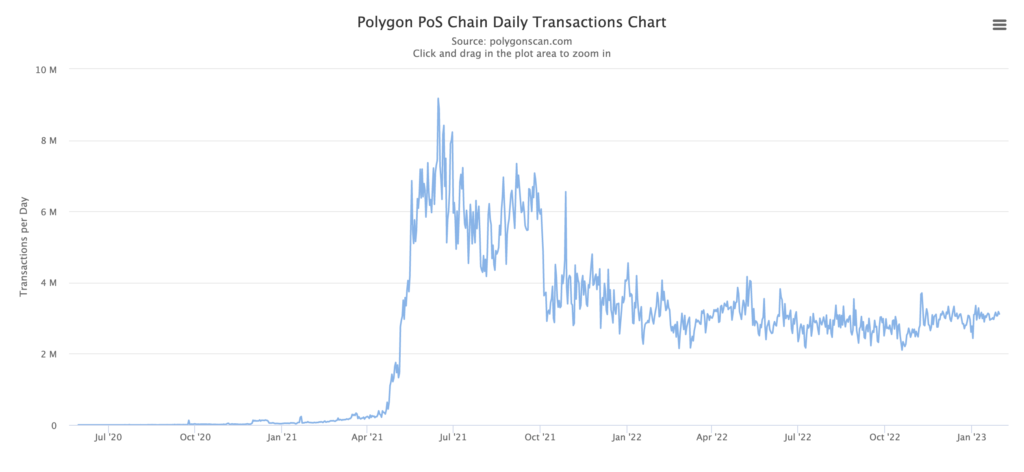

The Ethereum scaling solution has been recording wide swings in daily transactions and active addresses during the fourth quarter of 2022 as users scrambled to move funds during the implosion of Sam Bankman-Fried’s FTX crypto exchange.

Daily transactions on Polygon have been ranging from 2 million to 3.7 million, while daily active addresses are kept between 350,000 to 1.7 million. In line with this, daily gas fees also peaked, with the highest being $570,000 in November, while a month before that, the network experienced the lowest point at $16,000.

At this time, Polygon’s daily transactions were almost twice as high as that of the second-largest cryptocurrency network, Ethereum. Meanwhile, daily gas paid on Polygon was 40 to 100 times cheaper. Polygon actually successfully completed the Delhi hard fork in January, which is designed to reduce gas fees and address chain reorganisation.

Over the past two weeks, Polygon has also been recording an uptick of over 20% in daily active chain addresses. According to Token Terminal, 340,000 active users on Polygon surpasses Ethereum’s 320,000. Ethereum’s active addresses, however, have also been trending up this week, recording a 25% jump. But the first place is acquired by BNB Chain with almost 900,000.

Transactions processed on the Polygon network, on the other hand, are currently keeping more than 3 million transactions per day, much like BSC, but in contrast, Ethereum is only processing about a third of that at 1 million. Comparatively, the Bitcoin network processes around 300,000 transactions per day.

Technical Developments

The launch of Polygon’s zero-knowledge EVM public testnet also played an important part in the high activity the network is experiencing. With the prices in the crypto space down, projects are focused on building to support future growth.

According to a recent tweet by Polygon co-founder Sandeep Nailwal, the much-anticipated zkEVM update will be added to the Polygon network “soon.” This solution was first announced in July 2022 and has been available for testing via a public testnet since October.

The deployment of the Ethereum Virtual Machine (EVM) for Polygon’s ZK rollup means developers will be able to move smart contracts from Ethereum into the Polygon environment without a hitch. Zero-knowledge rollups (ZK-rollups) increase throughput on a blockchain by moving computation and state storage off-chain.

Flourishing NFT Sector

When it comes to the nascent non-fungible token sector, the popular NFT marketplace OpenSea dominates Polygon’s NFT sales. However, lesser-known marketplaces like Refinable, Treasureland, and NFTrade have also debuted on this cheaper and faster network to help the NFT sector grow on Polygon.

Recently, Polygon even paid DeLabs, the company behind some of Solana’s most popular NFT collections, $3 million to move from its competing chain. On top of this, NFT marketplace Magic Eden launched on Polygon this week in an attempt to boost its user retention.

“Polygon is known for the power of its business development and its ability to forge relationships and partnerships with really powerful brands that are actually onboarding a lot of people into the space, whether it’s Nike, Starbucks, Reddit, you name it,” said Tiffany Huang, Head of Marketing & Content at Magic Eden.”

The decentralised virtual world OrbCity (ORB), where users can explore and control their own cities using NFTs and multiple tokens, is another one to migrate to Polygon. The project has partnered with many industry heavyweights, including Huobi, OKX, and Animoca Brands.

Increasing DeFi Activity

Besides NFT, decentralised finance (DeFi) space has also been thriving on Polygon, with sharp growth observed here as well. Total value locked (TVL) on Polygon DeFI has spiked over 20% since Jan. 1 to hit $1.21 billion, according to DeFi Llama. This number, however, is nowhere near the June peak of almost $10 billion.

Lending protocol AAVE is currently the leading platform on Polygon, with a market share of 25%, followed by DEXs QuickSwap, Balancer, and Uniswap V3. Polygon, however, still sits at the fourth spot on the largest DeFi ecosystem list after Ethereum, Tron, and BNB Chain, having a TVL of $28.32 bln, $5.18 bln, and $4.87 bln, respectively.

This hype around DeFi has been drawing more attention to blockchain technology, in general, especially for those who are actually working on bringing more utility and value to users.

Growing Adoption

Besides all this, mainstream adoption and partnerships have been leading to this increase in activity on Polygon. The project has been busy rolling out new partnerships and initiatives this month. This involves blockchain analytics company Arkham intelligence and crypto custodian BitGo to provide staking capabilities for MATIC holders.

Decentralized exchange (DEX) Gains Network has also processed over $25 billion worth of trading volume on the Polygon and Arbitrum networks. The platform allows users to trade financial derivatives of different assets, such as U.S. stocks and indices, as well as tokens by matching user trades using smart contracts.

Besides crypto-focused projects, mainstream giants are also utilizing this network. Polygon has partnered with the likes of Meta, Starbucks, Robinhood, Stripe, Adidas, and Flipkart.

Recently, the Starbucks Odyssey loyalty program made members eligible to earn and purchase digital collectables in the form of NFTs on Polygon. Instagram also began testing new features to sell NFTs on the network.

Price Jumps

The spike in Polygon’s different metrics tells us that the crypto industry is continuing its momentum. This has kept MATIC’s price at a relatively high level. This is because users believe that the Polygon system solves many problems associated with Ethereum, such as transaction costs, scalability, and latency. As a result, many investors might see MATIC coin as an excellent choice to take advantage of DeFi, NFT, and crypto opportunities.

Reflecting Polygon’s growth, its native MATIC token soared 45% over the past month to now trade at $1.13. However, the $10.2 billion market cap token was still down about 61% from its all-time high of nearly $3 hit a year ago.

This makes Polygon the tenth-most valuable cryptocurrency by market cap, above Solana with $9 billion but below Dogecoin with $12.4 billion. Much like MATIC, Bitcoin’s price has risen to surpass $23,000, and the total crypto market cap has once again hit the $1 trillion mark.

Industry-Wide Maturity

So what does all of this development tell us about the crypto industry? Polygon’s spiked user base and activity give us a glimpse of the current state of the crypto industry, which shows we are currently in a state of consolidation, with many projects focused on development during this bear market.

It is also a testament to the strong interest in crypto despite the current market conditions. Investors are still willing to put their money into projects they believe in, and Polygon is clearly one of those projects. But most importantly, the spike in Polygon’s usage shows us that the crypto industry continues to grow even during the broad down market.

Additionally, it shows that the decentralised finance sector is still going strong. Despite the lack of enthusiasm in the market, DeFi protocols are still attracting users and processing billions of dollars worth of transactions.

So while the crypto industry may be down at the moment, there are still some bright spots. And the success of Polygon is a sign that the industry still has a lot of potential. This is a positive sign for the industry’s long-term health, showing that companies are still investing in their products and services despite the current market conditions. This consolidation period will likely lead to innovations and developments that will drive the market forward in the future.