The Blockchain…

If you’re reading this, chances are you’re pretty familiar with the concept of ‘blockchain’ and have heard of on-chain data. After all, the wide majority of cryptocurrencies (and nearly all the major ones) rely on some form of it.

As per Investopedia, it is a ‘digitally distributed, decentralised, public ledger that exists across a network’. In more simplistic terms, it can be conceived as a digital chain made up of interconnected blocks. Each of these building blocks is essential and contains a ‘hash’, an alphanumeric code, and portions of other important information. Every single block contains not only its own proprietary hash but also traces of the previous block. This makes blockchains virtually hack-resistant.

It’s this interlinked nature that lies at the core of a blockchain’s value and innovation. It makes the ledger a public object where no single individual or entity can control the data flow that regulates that chain’s historical transaction record.

This shift of trust from an institution (i.e. a bank or regulator) to the global collective is why many view cryptocurrencies as an alternative (and thus, threat) to the current world of centralised and institutionalised finance.

…And The Data On It

So, what is ‘on-chain’ data?

That definition covers all the information written on those blocks we described, and this is usually publicly available to any interested reader’s eyes.

This data is, however, not all of the same kind. It breaks down into a few categories, as below:

Transaction data

This includes the addresses currency is flowing from and to, the amount transferred, any fees paid by the transaction owner, or the balance outstanding in both addresses once the transaction is complete.

Block data

This can be miner fees, any potential processing rewards, or timecodes.

Smart contract data

This is information relating to the functions served by the contracts in question and is often codified.

Not everything that happens in a cryptocurrency’s blockchain is, however, publicly available ‘on-chain’. A portion of each transaction happens off-chain, or ‘off the record’.

For a variety of reasons, users of a certain blockchain might prefer to settle their token exchanges away from the public eye. These reasons range from attempts to dodge increasingly expensive transaction fees to a desire for increased anonymity or just faster execution.

This often means users might exchange wallet keys directly, thus moving ownership of entire addresses rather than the tokens they might contain. Another solution in this realm is the trading of crypto through an intermediary, vouchers, or coupons.

Aside from these specific cases, however, every other movement of tokens on a blockchain leaves a mark. The characteristics of this mark can be used to obtain important insights into that ledger’s activity and even the identity of its users.

Reading The Signs

Since the early days of Bitcoin, analysts in the cryptocurrency space have been trying to make sense of this plethora of publicly available data. The amount of financial and strategic upside unlocked by gaining a wider, more comprehensive understanding of market dynamics is huge. Certain applications of this on-chain data scrutiny can even anticipate market/price movements to a degree, which is essentially the golden goose of any type of trading.

The idea of interpreting on-chain data was popularised earlier on in 2011 through the CDD metric, an acronym that stands for Coin Days Destroyed. This was a concept born out of the realisation that transaction volume was meaningless outside of its context. A coin being moved hundreds of times back and forth should not be valued as hundreds of independent transactions, or it would risk creating an inflated perception of the network’s usage. The metric thus gives a new interpretation of transaction volume, by giving more weight to coin movements originating from dormant coins or those held long term, rather than coins moved frequently.

Similarly, the NVT (Network Value / Transactions) metric was developed in 2017 by Willy Woo to represent a crypto equivalent to the PE ratio (price to earnings) – one of the staples of equities fundamentals analysis. This indicator is really broad and covers the two main purported functions of Bitcoin: store of value (market cap or network value) on one hand, and payments network on the other (transfer volume). By looking at the balance between the two, investors can get an idea of whether Bitcoin is trading at a premium (high NVT ratio) or discount (low NVT ratio) – alas, if the network value is outpacing actual usage or vice versa.

As is clear, these two simple metrics can be employed to predict larger trends before they come to full fruition. There are many more, though – and a rising industry of on-chain data analysts ready to simplify their reading and make them available to any paying customer.

Providers And Tools

It might appear counterintuitive to have to go through a provider or intermediary to access what was just described as publicly available data. The truth is, however, that while there are no protocol barriers to stop anyone from accessing this data, there is a significant technological obstacle in place. The sheer amount of time, energy and money that running a node requires is not something any user can replicate from their personal laptop.

Even more so, the raw data in itself is only half of the value – the resource needed to analyse, structure and present this data in a readable, intuitive way is not indifferent.

For this reason, most investors keen on interpreting the blockchain through its on-chain metrics usually refer to analytics providers and their paid tools.

The basic level is made up of ‘blockchain explorers’ such as EtherScan, which lets you look up any Ethereum address or smart contract on the network – but without further analysis.

Moving up along the list of more complex tools we find Glassnode, probably the most famous Bitcoin analytics solution. Glassnode uses BTC’s on-chain info to track whale movements, realised market cap and mining data. It has a ‘freemium’ model which allows professional users to access more in-depth metrics through a paid portal, while still providing a fair share of precious analysis to free users too.

A tool which might explain the need for anonymity we described when writing about ‘off-chain users’ is the tracking tool developed by Nansen. The platform has taken it upon itself to de-anonymise several blockchains by tying specific alphanumeric addresses to institutional investors or ‘smart money’. With the entrance of major financial players in the crypto and NFT space, a key feature of the 2020-2021 bull run, the interest in tracking which projects their funds and interest are flowing to is greater than ever.

Lately, similar solutions were implemented for the NFT markets too, such as Dune Analytics’ OpenSea dashboard, or Deal Spotter, a device aimed at pinpointing digital art selling at a cheaper price than it deserves.

A Solution For All

While the complexity of its definitions and core mechanisms is best left to the specialists in the field, the tools produced by these analysis providers are definitely accessible and affordable for most retail and private investors too.

The growth seen in this sector and the resulting competitive space generated is also sure to continue to push innovation forward, and we’re confident on-chain analysis will become a staple of any good investor’s playbook in the years to come.

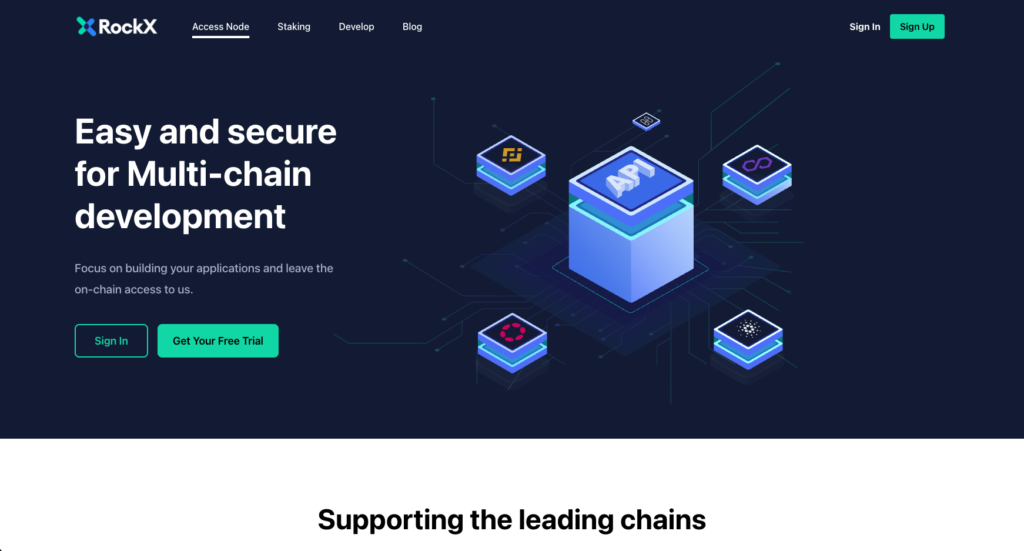

If you are keen on accessing on-chain data, RockX’s access node API portal offers both paid and free subscriptions. We are also currently giving away $100 credit to anyone who wants to try out the paid subscriptions on our portal. This offer lasts until 16 June 2022, Thursday, so if you’re keen on checking it out, you should do so before then!