The cryptocurrency world is undoubtedly gaining popularity and setting new boundaries every day. The rise of decentralized finance (DeFi) is one of the key reasons behind this exemplary growth. DeFi’s popularity over the last year has already surpassed that of initial coin offerings (ICOs) in 2017, currently noted as a USD$100 billion dollar industry.

Many decentralized finance projects have surfaced to facilitate a cheaper and more secure financial model as compared to the traditional system. Apart from trust, transparency, and reliability, there are many reasons why people have found themselves attracted to DeFi. One of these reasons is the possibility to earn considerable amounts of passive income from cryptocurrencies in a variety of ways, one of which is liquidity mining.

What is DeFi?

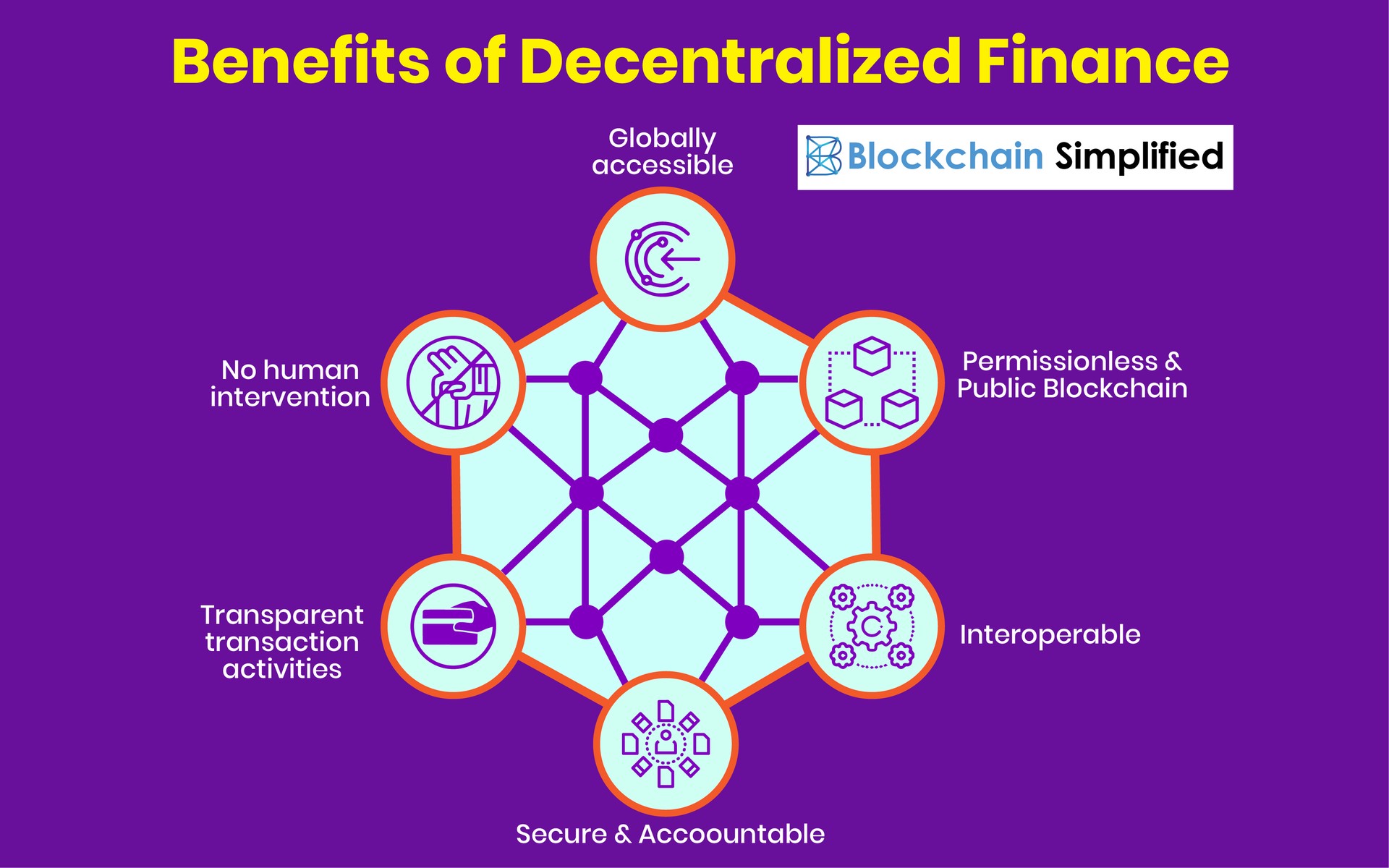

Before jumping into liquidity mining, it’s first important to understand what exactly is De-Fi. Decentralized finance (De-Fi) is a business model that leverages the concept of smart contracts and blockchain technology to maintain a distributed ledger of transactions that are regulated or governed according to pre-programmed conditions.

The concept is to operate a decentralized financial system that uses smart contracts to deliver financial services such as borrowing and lending. DeFi allows a digital money market that is unbiased and accessible to everyone.

At the heart of this, services such as staking or liquidity mining lie somewhere in the middle, offering investors to make more with their crypto. Rather than simply hodling their crypto assets, users can put them to use by placing them in marketplaces. These marketplaces are digital ecosystems that facilitate lending and borrowing. This means that they require definite liquidity to operate successfully. By providing this liquidity in the form of their own assets, users support the functioning of a marketplace and get rewards in return for their contribution.

Liquidity mining explained

The primary goal for a digital financial ecosystem on a blockchain is to be as liquid as it can be to facilitate functions of the money market. Liquidity mining is an act of providing liquidity via investor’s crypto assets to these ecosystems.

Users deposit their crypto assets in the platform in exchange for rewards. These incentives can take the form of getting a proportion of each trader’s fees or incentives in the form of tokens (usually native tokens). As most ecosystems provide their communities with a governance model, additional benefits such as voting rights can further incentivize liquidity mining. These voting rights allow further decentralization by distributing the power among the token holders to make key decisions regarding the protocol.

How liquidity mining works

The Automated Market Maker (AMM) is a collection of smart contracts that plays the role of a bank in the digital ecosystem. This means that the AMM maintains the lending and borrowing rates of the protocol based on various factors such as available liquidity.

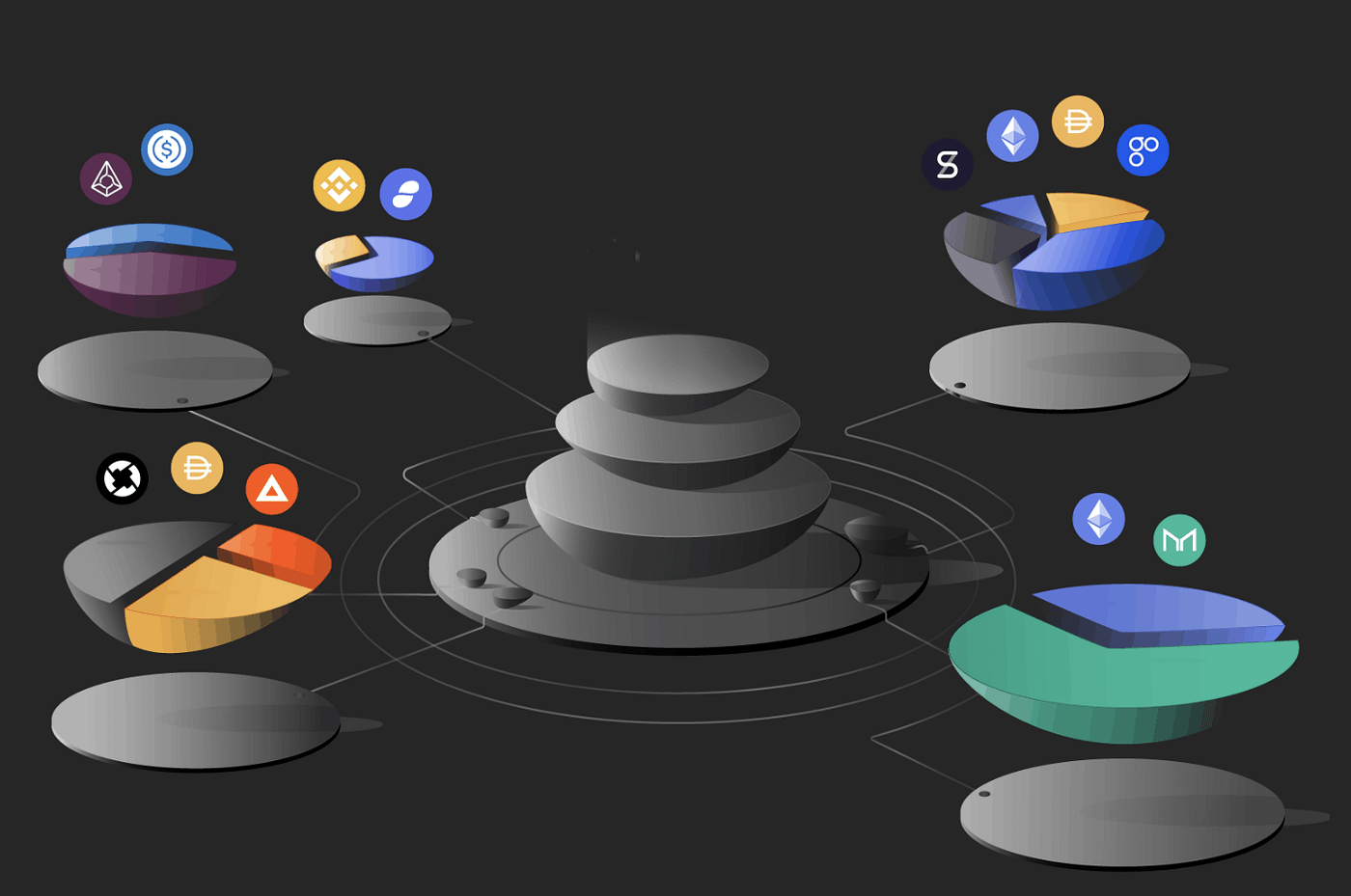

The two key concepts that govern the working of AMM are liquidity providers and liquidity pools. Liquidity providers deposit their crypto assets in the liquidity pools of the marketplaces to facilitate their token swapping, lending, and borrowing functions.

Each time a user makes use of such a function, he/she will pay a certain fee.

For instance, Uniswap — a popular De-Fi exchange — charges a 0.3% fee for swapping tokens. This fee is split between the liquidity providers based on their contribution to liquidity reserves. As far as the liquidity pools are concerned, each of them has its own distinctive features and rewards criteria.

There are three basic types of popular liquidity mining protocols, each with its own set of goals, decentralization qualities, and reward distribution mechanisms.

- Fair Decentralization — Governance tokens are generally distributed at the beginning to active community members.

- Marketed-oriented Protocols – Incentivizes the users to promote the platforms even before its launch.

- Progressive Decentralization – Implements governance token incentivization after several months of the launch.

The rewards for liquidity mining

Liquidity providers get rewards in the form of a percentage of trading fees, additional tokens, or even governance tokens.

But, the real question is, how big are the rewards?

While a savings account in the US or EU will yield users less than 0.5% on their funds. With liquidity mining, depending on the protocol, you can get up to a whopping 6%.

Annual Percentage Rate (APR) and Annual Percentage Yield (APY) are the two popular metrics that ascertain the rate of return based on the assets reinvested in the liquidity pool. However, since DeFi is a competitive market that offers volatile returns, the rewards may diminish as more investors enter the liquidity pool.

The risks in liquidity mining

The fact that DeFi is more complex than regular banking, there are certain risks that one has to keep in mind. DeFi protocols are still in the early stages of development, and there are numerous security loopholes that need to be addressed.

Even though a respected platform conducts numerous audits for its services, it is still susceptible to vulnerabilities, putting one’s hard-earned funds at risk. Due to the decentralized nature of the network, anyone can build their own liquidity pool based on fraudulent information. As a result, attackers will be able to steal tokens while users are unaware of the artificiality. The worst-case scenario is that the attackers gain access to the pool and manipulate the protocol to their advantage.

In addition, the exchange rate losses magnified by the fixed period deposits on certain protocols can increase the risk for the users.

Final thoughts

DeFi may have its risks, but a lot of those security issues are being addressed and fixed as you read this. With what is offered from a world of decentralized finance, DeFi is definitely making the future more appealing for average investors.

While the number of providers for liquidity mining is continuously increasing, it all comes down to the question of whether the suitable platforms are secured enough to put collective individual funds at risk. Decentralized exchanges may be reliable in trading coins, but they may lack the technological support to provide completely reliable, trusted liquidity mining service.

This is one of the reasons why companies like RockX exist. Aiming to help make investors lead the digital economy within a secure infrastructure for Web 3.0, the RockX team has been working on blockchain projects since 2019, providing a safe and secure technological infrastructure to support the most innovative protocols in the market.