Cryptocurrencies can be both risky and rewarding. Risky in a way that you can either lose or win in an instant. If you are not keen enough to observe what’s happening in the crypto market, its possible you may gain nothing and lose a whole lot (depending on how much you’ve invested).

With stablecoins, there is a lot less risk. Stablecoins are like a combination of cryptocurrencies and fiat currencies. The price is pegged to a fiat currency, such as USD, EUR, and other real currencies. The big difference stablecoins have from pure cryptocurrencies is that it doesn’t have the same level of riskiness, which is the reason why some investors resort to them, rather than in Bitcoin and altcoins.

Those who want to get exposed to the crypto market but don’t fully embrace the risk therein buy stablecoins to avoid the volatility of the market somehow. So, even if these investors don’t watch out for their investments all day, they don’t have to worry too much when the market is down since the fiat currencies can pull up the prices.

Why stablecoins are worth considering

Stablecoins are one alternative to consider if you want to get a taste of the crypto market, without doubling down on the potential risks. The following points below are reasons for why stablecoins are worth considering getting into:

More stable than pure cryptocurrencies

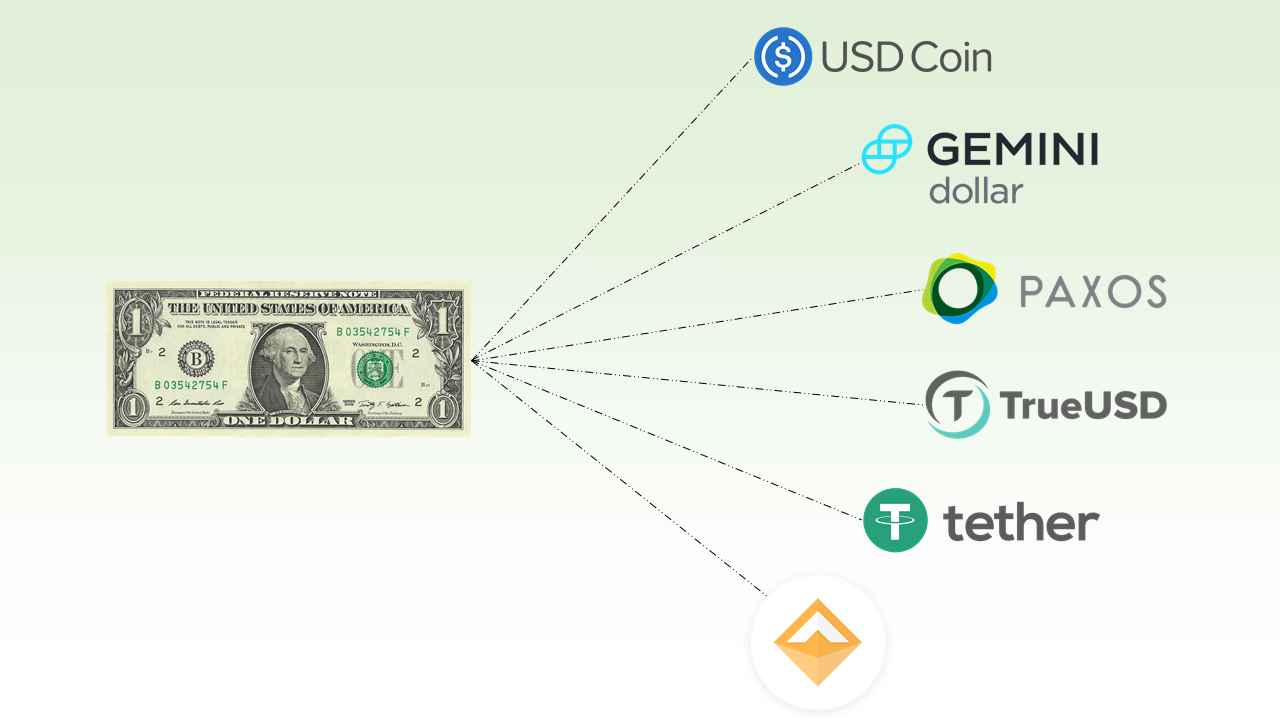

Due to the recent surge of popularity in crypto, even small retail investors can’t say no to investing into the market. If you feel the same, you don’t need to hold back. The crypto market offers a more stable investment than pure cryptos. Per Coinmarketcap, Tether (USDT), USD Coin (USDC), Binance USD (BUSD), and DAI are among the top choices there are in the market.

If you are looking for a more stable investment and you don’t want to risk your money all at once when you invest in cryptos, stablecoins are a good option.

More affordable

Like any other cryptocurrency, there is no need to put in a lot of money so that you can experience investing in stablecoins. It’s an affordable investment for starters. Even if you have a considerable amount to invest, you might want to diversify your investments to manage the risks. One way or another, you can invest in stablecoins without hurting your finances too much as compared to some crypto coins that can get costly.

There is less risky involved

Who wouldn’t want a less risky investment? Some investors are hesitant to enter the crypto market for one reason—they can’t tolerate the risk. Before you invest in crypto, you also have to know whether you have a low or high-risk tolerance. If you have a low level, stablecoins are a great alternative so you can invest in a less risky investment.

Great for investors with no time

Since stablecoins are relatively stable and less risky, it’s great for investors who don’t have enough time to spend reading charts and hoping the price of their crypto investments goes up. Even if you don’t monitor your investments in stablecoins, you still get to earn and keep your money. You can confidently leave your investments there for days or weeks without fearing that they will get liquidated if the market falls. Since fiat currencies can pull up the price, you can worry less.

Good start for those who are still learning the crypto market

There are investors who wish to invest right away despite not having enough knowledge of the market they are venturing in. Some newbies would immediately dive in without learning how to read charts. The good thing about stablecoins is that they are friendly to new investors. You can keep them for a long period while you are still learning how to invest in the crypto market properly.

Final Thoughts

In general, stablecoins are a good way to jumpstart your crypto journey. Whether you are a new investor or you’re looking for a better way to get exposed in the crypto market, you can definitely choose stablecoins as part of your investment strategy.