2022 was a brutal year for cryptocurrencies as the industry got hit hard by macroeconomic factors. A perfect storm of high inflation, rate increase, and quantitative tightening sent shockwaves through the markets, and crypto was not spared. Prices of major coins like Bitcoin and Ethereum fell sharply, and the total market capitalisation of the crypto market shrank by over $1.5 trillion.

The collapse of several centralised lending platforms like BlockFi and Celsius Network, in particular, was devastating. This destruction gave the crypto community an insight into the potential risks associated with these platforms – in particular, the risks of centralisation.

As we saw over the last year, the economic incentive of these platforms is to under-collateralise and take risks with user funds, which isn’t much different from the behaviour adopted by financial institutions that collapsed in 2008.

The crypto world is now learning that centralised lending platforms can be at a huge risk, much more so than their decentralised counterparts. The hidden risk of companies becoming insolvent or failing to pay back loans can completely wipe out customers’ crypto assets held by lenders. Therefore, it has become clear that borrowers should not rely solely on these platforms for their loan needs.

While these services may offer attractive terms in the short term, they can be an unreliable form of financing. When crypto companies and platforms fail to manage their risk exposure, investors can lose billions of dollars.

The Butterfly Effect

The collapse of mainstream centralised lending has taught us a lot about the potential of crypto. For one, it has shown us that crypto can be a viable alternative to traditional lending products. It has also shown us that not only can crypto be a more efficient and effective way of lending than traditional products, but it can also be more resilient and reliable.

However, 2022 showed that this problem wasn’t limited to mainstream centralised lending companies; instead, centralised finance (CeFi) platforms in crypto also face the same issues — the lack of transparency, which can lead to problems with security, trust, and confidence.

The lack of transparency and oversight on these unregulated lenders has exposed the vulnerabilities of holding cryptocurrencies with centralised platforms. It’s important for crypto companies to be able to provide customers with clear information about how their money is being used, as well as understand potential risks associated with making such investments.

In a repeat of the 2008 financial collapse, the collapse of these platforms caused a “run on the banks” across crypto markets. Some CeFi platforms got overwhelmed with users withdrawing funds, forcing them to freeze transfers off the platform, only for many of these platforms to turn out to be insolvent eventually.

The bankruptcy of these platforms also showed us just how a handful of crypto firms had far-reaching implications, leading to worry and concern across many different platforms. It further highlighted how risky it could be to trust one’s funds with a single platform, as well as how quickly such firms can go bankrupt.

A Harsh Lesson

The collapse of centralised crypto lending platforms has actually been an important lesson for the nascent crypto lending industry. Unsecured crypto lending businesses were not prepared to tackle the ongoing crisis that ensued, and market entrepreneurs were unable to adequately provide capital to those in need.

This has led institutional crypto lenders and market regulators to examine how comfortable they should be with such lending platforms.

It has been a wake-up call to the crypto market, as many believe that bad decisions and poor market conditions had a spiral impact on the centralised platforms. The effect of this collapse was felt in multiple platforms and had a greater impact than just those directly involved with the failed platforms.

The debacle has made it clear that crypto investors need to be aware of the risks and rewards involved with investing in certain lenders’ platforms and mindful of their exposure when it comes to lending and custody of their crypto assets.

In the aftermath, big crypto investors have been left with significant losses as the cryptocurrency prices plunged and customers could not withdraw their funds from these platforms.

For instance, according to bankruptcy filings, BlockFi’s assets and liabilities both total between $1 billion and $10 billion, with over 100,000 creditors, while Celsius owes $2.8 billion worth of crypto to investors.

The collapse shows us that there is a great deal of work to be done in terms of developing robust infrastructure and protocols. But more importantly, they highlight the importance of decentralisation.

Decentralisation is Key

The crypto community is learning the lesson of decentralisation the hard way. While centralised lending institutions deal with crypto assets, their business models are centuries old.

Rather than relying on old traditional banking models, borrowers should look to DeFi protocols and decentralised networks for better deals when it comes to cryptocurrency-backed loans. Decentralised platforms have enabled lending models that allow investors to borrow against their cryptocurrency holdings without relying on a centralised platform for intermediation or security.

DeFi platforms are designed to preserve the benefits of permissionlessness, transparency, censorship resistance, and self-sovereign custody of assets.

Despite the recent sell-offs in the crypto market, DeFi platforms like Uniswap, Balancer, and Curve have been functioning smoothly, allowing users to exit their positions. Although users saw their portfolios decrease in dollar value, they never lost access to their assets.

This shows that decentralised lending platforms are more resilient to shocks and can continue functioning even when centralised platforms collapse. This makes them a more reliable funding source for institutions and individuals. They also offer more transparency and accountability than centralised ones. Lenders can see exactly where their money is going and how it is being used. This helps to build trust between lenders and borrowers.

This means that even if one platform fails, the other platforms will continue operating unaffected, and loans will still be processed through them without interruption in service. Platforms such as MakerDAO have introduced collateralised loan models, which protect lenders from potential losses even during volatile markets as long as sufficient collateral supports the loan amount.

This is a testament to the level of innovation that the entire crypto ecosystem has achieved, enabling the crypto market to remain resilient in times of market crisis.

Regulation is Imminent

The rise of crypto lending platforms like Celsius and BlockFi has been meteoric. In just a few short years, these platforms have facilitated billions of dollars worth of lending transactions. However, the recent collapse of centralised crypto lending platforms like Celsius and BlockFi has cast a shadow of doubt over the industry’s future.

With people losing a ton of money in the recent crypto collapse, this has led to calls for stricter regulation of the crypto lending sector. Already, the US Securities and Exchange Commission (SEC) has been working to have crypto lending companies register.

BlockFi reached a $100 million settlement with SEC for failing to register the offers and sales of its retail crypto lending product last year while the agency was probing into Celsius and Gemini due to their high-yield products, which sparked its investor protection concerns.

It is clear that regulation is coming, and this will likely make it harder for new crypto-lending services to start up and operate. And this is likely to continue in the future as the sector attempts to rebuild its reputation in the eyes of the public. As such, crypto platforms are also adapting to stricter regulatory regulations.

But regulators must recognise that DeFi does better at consumer protection than CeFi, and they need to develop regulations that protect consumers without stifling innovation.

The Fall of Centralised Lending

As we saw, the collapse of centralised lending has now made it clear that there are risks associated with these platforms. Investors should be aware of these risks when considering using such services for their investments, and any platform offering such services should have appropriate safeguards in place to ensure their clients’ funds are protected from externalities outside of their control.

It also made the advantages of decentralised lending platforms very clear. They are more resilient, transparent, and accountable than centralised ones. This makes them a better choice for businesses and individuals who need access to reliable funding.

While centralised lending protocols may have failed, the lessons we have learnt from their collapse will help us build a stronger and more resilient crypto ecosystem in the future.

Is Staking an Alternative to Lending and Borrowing?

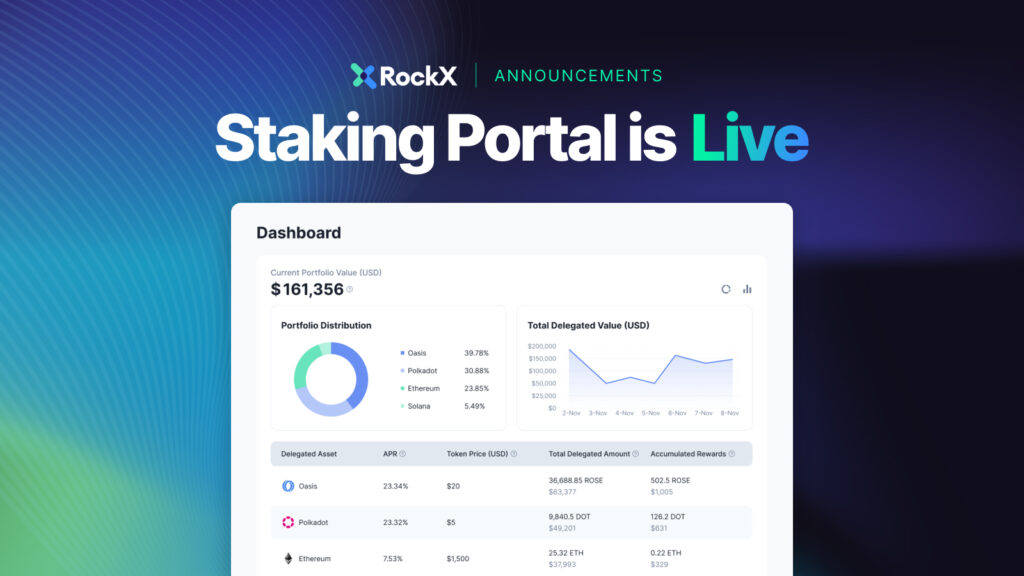

For crypto token holders who want to continue earning yield by lending, staking might be a viable alternative. Staking is a great way to contribute to the decentralisation of Proof of Stake blockchains while earning a stable yield on your digital assets.