Written by @enijoshua_

Did you know that the energy Ethereum used to process a single transaction in its former Proof of Work system could charge 9,600 phones for one hour? With the transition to Proof of Stake (PoS), Ethereum’s energy consumption has drastically reduced, thanks to validators and nodes who offer a more eco-friendly and scalable solution. Today, we’ll dive into who validators are, what they do, and how you can make money by becoming one.

Introduction

Decentralization is at the beating heart of blockchain technology and cryptocurrency. There’s no central gatekeeper managing the blockchain’s transaction record. Instead, an army of participants verifies transactions and adds them to the blockchain using consensus mechanisms.

A consensus is like a board meeting where everyone agrees on whether to add a transaction to the blockchain if it follows the rules or reject it if it’s false. There are two main types of consensus mechanisms: (1) Proof of Work and (2) Proof of Stake.

In a Proof of Work system, powerful computers solve complex math puzzles to verify transactions and secure the network. Ethereum started as a PoW blockchain, consuming about 48 kWh per transaction — enough to charge 9,600 phones for an hour! Now imagine having 1.2 million transactions to process per day. Can you see the challenge?

To tackle this, Ethereum transitioned to Proof of Stake on September 15, 2022, in an event known as “The Merge.” This drastically cut energy consumption and set the stage for future scalability improvements like sharding. Now, Ethereum relies on nodes and validators to agree on transactions and blocks.

Nodes And Validators: What’s The Difference?

- Nodes: Think of nodes as board members who keep records of the blockchain’s data, verify transactions, and communicate with other nodes to maintain network integrity. They don’t propose or validate new transactions.

- Validators: These are special nodes that propose new blocks and validate the blocks of others. Validators must stake some ETH to participate, adding an extra layer of security to their actions.

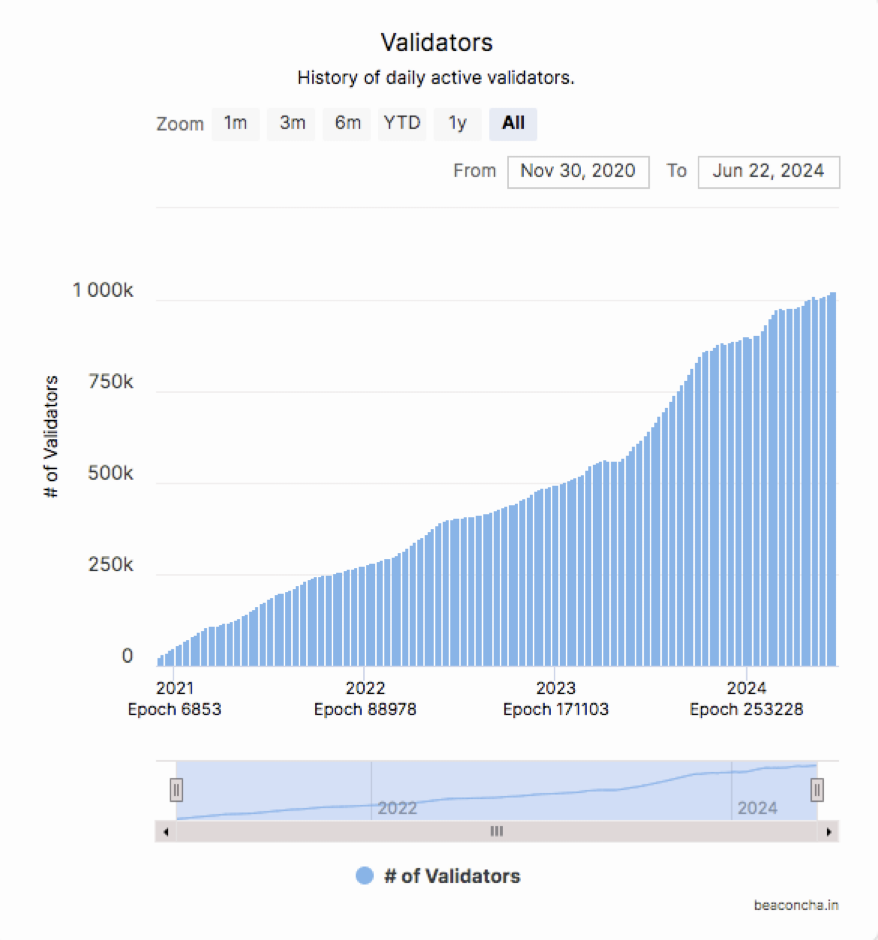

The Current Validator Landscape on Ethereum

Ethereum currently has over 1 million active validators globally, ranging from individuals to professional staking services and institutional players. This diversity ensures the network remains secure and less prone to centralization risks, promoting adoption in various applications, from decentralized finance to non-fungible tokens, and reducing the chances of 51% attacks.

In a 51% attack, a bad actor owns more than half of the staked cryptocurrency, giving them the power to mess with the blockchain. This would be extremely expensive, and even if it happened, the honest validators on the network could vote to ignore the altered blockchain and destroy the staked ETH of the attacker.

What Validators Do

In Ethereum’s PoS system, validators are randomly chosen to:

- Propose and Attest Blocks: Validators suggest new blocks of transactions for the blockchain and confirm blocks proposed by others to ensure correctness and fairness.

- Security and Rewards: Validators secure the network by verifying transactions. They earn rewards for honesty and face penalties for misbehaviour or inactivity. Your 32 ETH can get slashed if you’re offline or dishonest.

- Consensus Participation: Validators work together to agree on the state of the blockchain in a process called consensus, ensuring everyone on the network has the same up-to-date information and keeping the blockchain trustworthy.

How Validators Make Money

Validators make money in various ways:

- Verifying Blocks: Validators earn rewards for verifying blocks proposed by others, checking their legitimacy, and voting on whether to add them to the blockchain.

- Sync Committee: Validators in sync committees get extra rewards for keeping everyone updated with the latest blockchain info.

- Staking Payouts: Validators get rewarded in ETH for being part of the consensus mechanism, receiving newly created ETH and transaction fees from blocks they propose and validate. The more ETH you stake, the bigger your rewards.

- Block Proposals: Validators earn extra ETH for proposing new blocks. You get a cut of the transaction fees and any “tips” (priority fees) included in the block. The more ETH you stake, the more likely you are to be picked to propose a block.

- Maximum Extractable Value (MEV): Imagine you’re in a crowded line to buy movie tickets and someone cuts in line (front-running), pays a bit extra, and gets their ticket before you. MEV is the profit a validator makes by rearranging, front-running, or processing transactions to take advantage of price differences.

The total reward for a validator depends on these factors, including the amount of ETH staked and the total number of validators on the network. On average, you can expect an annual percentage yield (APY) between 4% and 10%.

How Validators Lose Money

- Missed Duties: Validators have two primary roles: checking new blocks and proposing new ones. Failing to do these tasks on time results in missing out on rewards.

- Inactivity Leak: Validators must stay online and participate actively. Short downtimes might not cost much, but repeated or extended outages can lead to significant losses.

- Technical Issues: Running a validator involves managing sophisticated software, which can have bugs or vulnerabilities like security breaches, leading to downtime and slashing.

- Slashing: Slashing is a severe punishment that discourages validators from acting dishonestly and protects the network from attacks. Slashing occurs when a validator attempts to:

- Cheat the System: Proposing two conflicting blocks for the same spot in the chain creates a fork, potentially leading to double-spending vulnerabilities.

- Mess with History: Attesting to a block containing another already finalized block disrupts the chain’s structure and creates inconsistencies.

- Confuse the Network: Double voting by supporting two different validators for the same block undermines the consensus mechanism.

Of course, there’s a price for misconduct:

- Losing stake: A portion (1/32nd) of the validator’s staked ETH is permanently removed from circulation.

- Forced Timeout: The validator is forced out of the network for 36 days, during which their remaining stake slowly diminishes. This prevents them from coming back to cause problems.

- Discouraging Collusion: Halfway through the removal period, a “correlation penalty” is applied. This penalty gets harsher the more validators are slashed together, making coordinated attacks very expensive.

Getting Paid and Avoiding Penalties

No one starts a business to lose money, right? Here are three ways to avoid getting slashed:

- The Right Setup: Use dedicated hardware and a reliable internet connection to ensure maximum uptime and performance.

- Be Active: Participate in all aspects of validation, including sync committees, and stay active during peak times to increase rewards.

- MEV Mastery: Maximize earnings by effectively managing MEV opportunities using tools that help capture additional value from transaction reordering and other strategies.

Different Staking Options

- Solo Staking: Offers the most control and potentially the highest rewards but requires significant technical skills and resources.

- Liquid Staking: Platforms like Lido let you stake your ETH and get liquid tokens (stETH) in return, which can be traded or used in DeFi applications while still earning staking rewards.

- Staking-as-a-Service: This option allows you to stake your ETH while a third party handles the difficult validator node operations.

Why Do People Choose Ethereum Over Other Blockchains?

- Thriving Ecosystem: Ethereum hosts a vast array of decentralized applications, financial services, and digital assets.

- Economic Incentives: Ethereum’s staking rewards are competitive, and the potential for earning MEV rewards adds another financial perk.

- Support: The Ethereum community offers resources, forums, guides, and technical help, making it easier for new validators to get started.

- Decentralization and Security: Ethereum’s focus on decentralization and security is constantly improving.

How To Set Up Your Own Validator on Ethereum

This guide walks you through the steps for becoming a validator on the Ethereum network. Be aware, that this process requires technical expertise.

- Hardware Requirements:

- A reliable, modern computer.

- For ideal performance, aim for an Intel NUC (7th gen or newer) with an x86 processor, 16GB-32GB RAM, a large SSD (at least 2TB), and a stable internet connection.

2. Install the Necessary Software:

- You’ll need an execution client, a consensus client, a validator client, and additional tools.

- Install by downloading pre-built versions, compiling from source code, or using package managers.

- Experience with command lines and Linux/Unix commands is needed.

3. Configure the Validator Node:

- Edit configuration files, set up network settings, and generate cryptographic keys.

- A solid understanding of configuration file structures, command syntax, and tools like “geth” and “geth attach” (for interacting with the network) is required.

4. Maintenance:

- Regularly monitor logs, update software, troubleshoot issues, and ensure the node stays online.

- Be familiar with log analysis tools, interpreting error messages, and applying updates using command-line tools or package managers.

In short, running a validator is too complex for a busy person like you.

Skip the tech stuff, just earn rewards!

Instead of wrestling with complicated software, you can lock up your ETH with a trusted validator like RockX. We do the hard work of validating transactions and keeping the network safe, while you get the rewards (minus a small fee). It’s like renting an apartment instead of buying a house.

Benefits of Delegated Staking

- Ease of Use: Less technical involvement, freeing up your time to manage your project instead of worrying about the details.

- Lower Risk of Downtime: Professional services ensure high uptime and security.

- Access to Liquidity: Some services offer liquidity tokens representing your staked ETH, which can be traded or used in DeFi platforms.

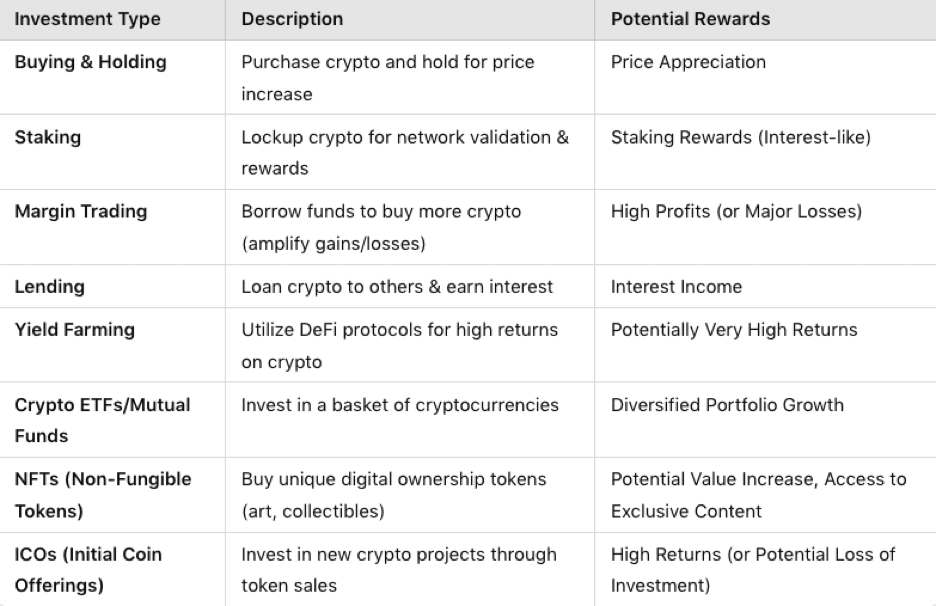

Staking Vs. Other Crypto Investments

In addition, staking offers you:

- Predictable Income: Earn regular rewards like interest without active trading. Great for long-term holders.

- Lower Risk: Less risky than margin trading or yield farming. More stable returns and no need for constant market monitoring.

- High Yields: Offers returns often higher than traditional savings accounts, ranging from 4% to 10% annually.

- Flexibility: Choose different lock-up periods or liquid staking options for liquidity and rewards.

- Compounding Rewards: Reinvest rewards to boost long-term gains through compounding.

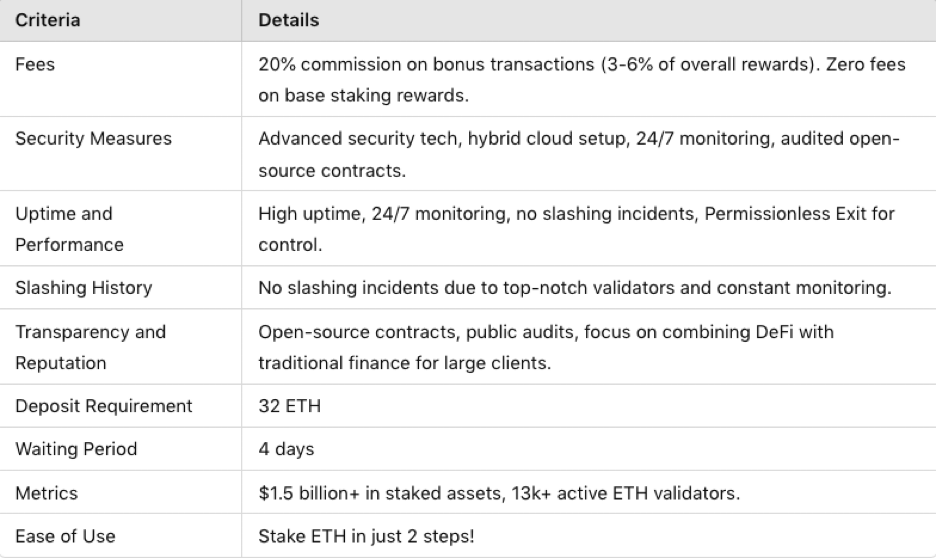

Finding the Best Crypto Staking Partner

When choosing a validator service provider, consider the following criteria:

- Staking fees.

- Waiting period.

- Slashing history.

- Security measures.

- Deposit Requirements.

- Uptime and performance.

- Transparency and Reputation.

Evaluating RockX: Are We Good Enough?

Additionally, you’ll enjoy:

- Simple staking: Our audited staking contract enables you to spin any multiple of 32 ETH in a single transaction, which reduces the risk of human error

- Easy monitoring: Our all-inclusive dashboard allows you to monitor your validators’ performance and claim rewards.

- You’re in control: Your funds go straight to a validator on the network, and you get your rewards directly from the blockchain itself.

Final Words

Being a validator on Ethereum sounds cool, but it’s too complex. By letting RockX handle your ETH, you can earn staking rewards without being a “tech bro,” allowing you to focus on other aspects of your life while earning passive income. Click here to stake ETH in just 2 steps