RockX has joined forces with Babylon to bring about the next zero-to-one innovation on Bitcoin. This will enable non-custodial staking of BTC that generates yields in exchange for providing economic security to external Proof-of-Stake (PoS) chains. With a market cap of US$1.3T, BTC is the most valuable network today and is perfectly positioned to take advantage of the burgeoning restaking narrative. By creating a suite of Bitcoin security-sharing protocols, Babylon provides a critical primitive upon which staking protocols can be built.

2024 has been the year of Bitcoin’s resurgence with BTC setting a new all-time high on the back of many bullish catalysts, chief amongst them the BTC ETF approval by the US Securities and Exchange Commission. With financial hubs such as Hong Kong following suit with their own BTC ETFs, institutional and retail inflows have propelled BTC’s market capitalization to over 1.23T US dollars (as of 2024-04-17T22:00:00+0000).

Crucially, Bitcoin dominance has been trending upward since the start of the year, solidifying its position as the most valuable public blockchain.

However, Bitcoin was not built with an ecosystem in mind like some newer blockchains might have been. Due to its lack of smart contract functionality, yield opportunities are lacking on the network. There aren’t currently many ways to generate yield from BTC outside of trading it or through the use of custodial services.

Enter Babylon: a protocol that utilizes idle BTC to secure other PoS networks. This results in greater security through decentralization and gives BTC holders a new way to earn.

A leading provider of non-custodial institutional staking infrastructure, RockX is a proud active participant in Babylon’s BTC Staking Testnet. By participating in the testnet, RockX hopes to help solidify the technology behind this feat and support Babylon in the upcoming BTC staking phases. As an infrastructure provider, RockX handles all the development requirements from setup to maintenance of staking nodes. When Babylon moves its BTC staking protocol to mainnet, this will be no exception.

Restaking Narrative Taking Over DeFi

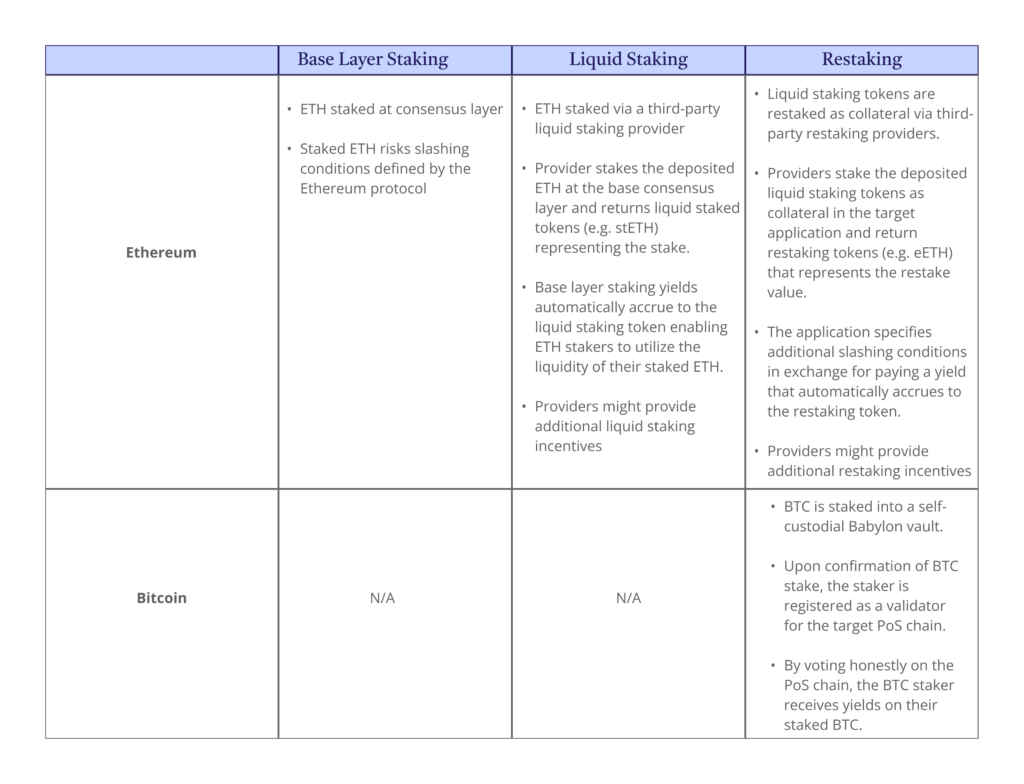

Restaking, or more formally the rehypothecation of assets securing a network, has recently seen an explosion of interest as stakers rush to generate additional yield on top of their existing PoS staking returns. Introduced by EigenLayer on Ethereum, restaking tokens have seen their cumulative market cap balloon to over US$4Bn in less than a year. By taking on incremental slashing conditions on their staked assets, users can generate increased yield through restaking in this rapidly growing market.

“Restaking” describes the Ethereum PoS paradigm as stakers reuse their staked ETH to secure other applications in exchange for yield via smart contracts. Actively validated services (AVS) leverage Ethereum’s strong security through EigenLayer to secure their trust network through restakers and pay extra yield to these restakers in return.

As a Proof-of-Work blockchain, Bitcoin is secured by computational power (i.e. work) invested into the network and not BTC. As such, the concept of staking, where a chain’s native asset is pledged as collateral to secure the network, is not applicable. Babylon has now introduced the concept “staking” to Bitcoin. This concept of borrowed security is done through cross-chain staking, allowing users to use the value of their BTC to secure select PoS blockchains.

Babylon Bitcoin Staking

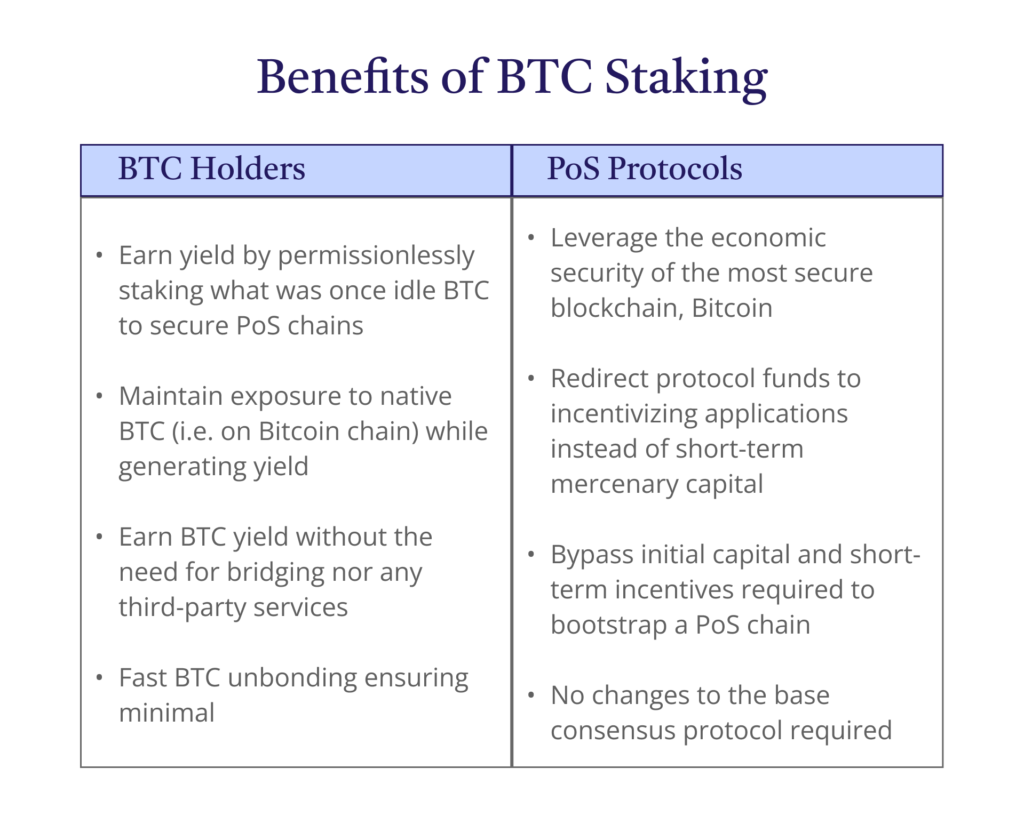

At its core, Babylon addresses 2 critical needs of the cryptocurrency market:

- Proof-of-Stake capital dependency: The security of a PoS network depends on the value of the assets staked. Due to network effects, such capital can be hard to attract with projects usually adopting extremely high inflation rates to incentivize more capital through exaggerated staking yields. This hyper-incentivization is not only unsustainable but also diverts what are limited protocol funds away from building application use-cases on the chain. It is much easier and cheaper for smaller PoS chains to pay for borrowed economic security from an external established blockchain.

- Proof-of-Work capital dormancy: PoW blockchains, such as BTC, secures the network through utilizing computational power to solve complex mathematical puzzles. As such, BTC inflation is instead directed towards miners who have invested resources into mining hardware and infrastructure. Consequently, BTC holders do not benefit from any form of native yield generation as their assets are idle and not actively securing the network.

In effect, Babylon matches PoS chains that are willing to pay yield in exchange for security and BTC holders whose BTC is economically secure but does not generate yield. By depositing (i.e. staking) BTC into a non-custodial vault which implements the PoS chain’s slashing rules, BTC stakers pledge the value of their staked BTC in exchange for yield from the PoS chain. Crucially, this process does not require third party services nor the transfer of BTC ownership hence retaining the security and decentralization aspects of Bitcoin.

Babylon has committed to making the Bitcoin staking protocol open-sourced once the core primitives have been developed. You can view the full list of Babylon ecosystem integrations here.

How Does It Work?

Image source: https://docs.babylonchain.io/docs/introduction/architecture

To achieve shared security between BTC and other PoS chains, timing synchronicity is key. Hence, Babylon utilizes a BTC timestamping service whereby any arbitrary data (in this case, PoS chain state) can be submitted to Babylon to obtain Bitcoin timestamps. By iteratively creating checkpoints of the PoS chain state on Bitcoin, the history of the PoS chain up until the point of the timestamp is backed by the economic security of BTC. In other words, changing the history of the PoS chain also requires the malicious attacker to modify Bitcoin’s consensus which is a much tougher task.

Bitcoin staking builds atop this timestamping service by requiring BTC to be deposited into a slashable non-custodial vault before a user becomes eligible to vote on PoS blocks and earn yields. Once bonded, BTC stakers can vote in a finality round which takes place after each voting round on the base PoS consensus protocol. Blocks are only considered finalized when ⅔ of the BTC staked have voted for the block. In the case where a double-signature by a malicious attacker is detected, the private keys of the bonded BTC will be leaked resulting in fully slashable PoS security.

Given Bitcoin’s constrained scripting abilities (i.e. no smart contract capabilities), a Cosmos-SDK based Babylon chain was created and functions as a control plane to ensure synchronicity between the Bitcoin chain and connected PoS networks (i.e. data planes). A separate Babylon chain was required as storing data directly on Bitcoin is prohibitively expensive given the demand for limited block space as well as the associated transaction fees. The Babylon chain is able to communicate securely with the integrated Bitcoin and PoS chains through the standard IBC protocol.

By combining the technical solutions above, Babylon adopts a modular remote staking approach which integrates Bitcoin into the PoS economy. The Babylon solution leverages modern cryptography techniques to achieve full slashable security guarantees as well as fast stake unbonding to minimize capital opportunity costs.

What Does This Mean?

The introduction of permissionless Bitcoin staking brings some fundamental changes to BTC as an asset. Primarily, BTC holders can now generate yield without having to rely on custodial services. Before the Babylon solution, BTC yield generation still required BTC ownership to be transferred thereby introducing third-party trust risks:

- Centralized Exchanges (CEX): Deposit BTC to the CEXs wallet and you can earn yield by locking your BTC with the CEX. The yield is generated through various CEX investment strategies utilizing the locked BTC. This does not allow participation in DeFi.

- Bridging Services (e.g. WBTC): Deposit BTC to a third-party wallet and an ERC20 representation of your Bitcoin (e.g. WBTC) will be issued to you on EVM compatible chains with smart contract functionality. This enables you to utilize a wrapped representation of BTC in various DeFi strategies to generate yield (lending, market making, etc.).

With Babylon, BTC holders can now generate yield natively on the Bitcoin chain. Furthermore, with the future introduction of liquid restaked BTC, holders can earn yield while participating in DeFi on other networks that are more ecosystem-oriented. This significantly improves security while discouraging BTC concentration into a few third-party controlled wallets. With more incentives to hold onto native BTC, Bitcoin on-chain liquidity will also likely improve. Bitcoin staking also introduces a utility element to BTC which has traditionally functioned more as a store-of-value.

As a BTC holder, Bitcoin staking brings the following benefits:

- Convert your BTC holdings from idle assets to yield-generating assets

- Earn yield on BTC without any counterparty risks

- Maintain exposure to native BTC on the main Bitcoin chain while generating yield

- Contribute to the security of connected PoS chains in exchange for yield

- Minimize liquidity opportunity costs with fast unbonding of BTC stake

- Depending on the PoS chain secured, reduce staking management overhead by delegating your votes to a trusted operator

In exchange for native BTC yield, stakers will have to be wary of the following risks:

- PoS specific slashing conditions: The slashing conditions on the staked BTC will be dependent on the validator rules implemented by the selected PoS chain. Each chain implements a different set of rules hence BTC stakers must be aware of the PoS specific slashing conditions. This includes changes in slashing conditions and how to implement such upgrades.

- Uptime requirements: Many PoS protocols require validators to be constantly contactable or else the validator’s stake will face slashing penalties. As such, access to reliable computing and connectivity infrastructure is a must. Alternatively, stakers can host their nodes on a trustworthy node hosting service in exchange for a fee.

- BTC staking time lock: Babylon implements a time lock on staked BTC. As bonded BTC can only be withdrawn following this time lock, stakers should factor this delay into their liquidity considerations.

- General scripting vulnerabilities: While there are multiple instances of restaking on smart contract chains, Babylon is the first to do so utilizing Bitcoin’s limited scripting functionalities.

These can be mitigated or limited by staking BTC through an operator such as RockX once BTC staking becomes available as a service.

How to Get Started

Currently, Babylon Bitcoin staking is only on testnet. Soon, however, BTC staking will become more accessible through platforms like RockX. In the meantime, BTC staking requires the installation of multiple software packages on the target node device via backend code. While this enables secure local communication and synchronicity between various blockchain nodes, it is also a heavily involved process consisting of the following steps:

- Install Golang on a Linux system

- Build and install the Babylon full node

- Configure Babylon node and peers

- Generate a BLS key for signing transactions at the end of each epoch

- Create and verify the Babylon validator with the target chain ID

- Install the finality provider on Babylon node that enables voting on the finality round

- Install the EOTS (Extractable One Time Signature) Daemon for managing voting signatures

- Install the Finality Provider Daemon that enables finality votes submission

- Build and install the Bitcoin node

- Build and install Babylon’s BTC Staker helper

- Stake BTC via Babylon’s BTC Staker

The setup steps above have already been summarized but each step consists of multiple instructions that can be found on Babylon’s Docs.

RockX’s Role on Babylon

RockX has been an active participant in Babylon’s BTC staking testnet and eagerly following its development. We are happy to announce support for Bitcoin staking on Babylon’s launch. This means that instead of the significant overhead required to set up and maintain your own Babylon validator, you can leverage RockX’s no-code interface to deploy your Babylon validator and start earning yield in just a few clicks.

With best-in-class security and a dedicated team monitoring your nodes 24/7, RockX ensures you get optimal staking yields with protection from server downtime and duplicate signing keys. By staking your BTC with RockX, you can focus on generating the best yields from the myriad of integrated PoS chains.

Conclusion

Native Bitcoin staking is set to revolutionize BTC as an asset class turning it from what was once an idle store-of-value into a yield-generating asset securing a myriad of PoS chains. For the first time in Bitcoin’s history, BTC holders can generate yield without the need for any counterparty/custodial services. As an extremely promising crypto primitive, Babylon is setting the stage for significant innovation leveraging Bitcoin’s economic security.

RockX is helping to realize this decentralized future by making it as easy as possible for both institutions and individual stakers to start up and operate their own Babylon Bitcoin staking validator. With an intuitive Staking UI with expert yield management dashboard functionalities and a dedicated, highly experienced team, RockX forges ahead at the forefront of decentralized technologies. Once available, we aim to make Babylon’s BTC Staking network accessible to everyone, paving the way for a future where BTC holders can seamlessly stake their BTC and earn yield for securing the crypto ecosystem.